Category Archives: aktualnosci-en

Cedric Fromont becomes the sole shareholder and CEO of Valians International!

Business Opportunity: Digital Technologies

Microsoft Announces PLN 2.8 Billion Investment in Cloud and AI Infrastructure, Skilling, and Cybersecurity in Poland

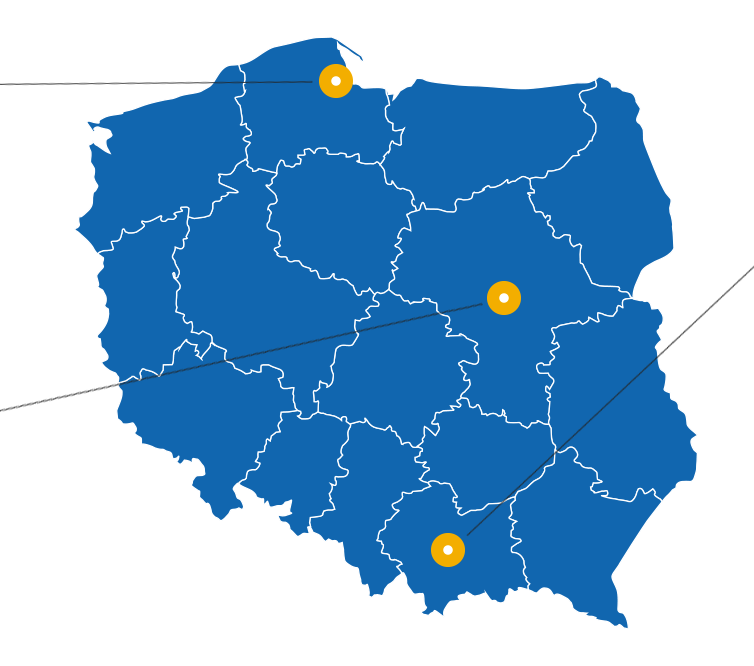

Microsoft has unveiled an ambitious plan to invest PLN 2.8 billion by June 2026, aimed at expanding its cloud and artificial intelligence (AI) infrastructure in Poland. This significant investment will not only enhance Poland’s technological landscape but also strengthen the nation’s global competitiveness, bolster cybersecurity efforts, and create a skilled workforce ready to thrive in the digital age.

A New Chapter in Poland’s Digital Transformation

The $2.8 billion commitment is part of Microsoft’s ongoing efforts to expand its hyperscale cloud infrastructure in the country. The investment will support the growth of existing data center campuses, bringing a broader array of Azure services to meet the increasing demand from Polish businesses and organizations. This move is designed to foster the accelerated adoption of AI and cloud technologies, positioning Poland as a hub for innovation and digital advancement in the region.

Microsoft’s expansion in Poland is poised to benefit multiple sectors, from healthcare and finance to retail and manufacturing. By bringing cutting-edge cloud solutions to the forefront, this initiative will help Polish businesses enhance operational efficiency, streamline processes, and drive innovation. Furthermore, it is expected to attract global businesses to Poland, increasing the country’s economic competitiveness.

Collaboration with the Polish National Defense to Strengthen Cybersecurity

In addition to its investments in cloud and AI, Microsoft has announced a strategic partnership with the Polish National Defense. The collaboration will focus on fortifying national cybersecurity by developing a comprehensive framework designed to defend against the growing threat of cyberattacks. As highlighted by Microsoft’s Digital Defense report, Poland ranks third in Europe and ninth globally in terms of exposure to cybercriminal organizations, making this initiative crucial for national security.

This partnership will include the development of AI competencies, as well as the application of emerging disruptive technologies like cloud computing, AI, and quantum computing. Microsoft’s Vice Chair and President, Brad Smith, emphasized that this investment represents a vote of confidence in Poland’s leadership and economy, with the ultimate goal of enhancing Poland’s cybersecurity resilience.

Empowering the Polish Workforce with AI and Digital Skills

A core aspect of Microsoft’s investment is its commitment to skilling the Polish workforce. By 2025, Microsoft aims to train 1 million Polish workers, including information workers, teachers, software developers, and organizational leaders. The company’s AI skilling initiative will focus on equipping individuals with the digital proficiency needed to excel in today’s fast-evolving technological landscape.

This initiative builds on Microsoft’s previous efforts, which have already trained over 430,000 people in Poland in digital skills between 2020 and 2023. The company’s broader vision is to foster a digitally literate population that can leverage AI and other emerging technologies to drive Poland’s economic growth.

Additionally, Microsoft has committed to providing discounted and donated software to Polish educational institutions, nonprofits, and public libraries. Over the past year alone, Microsoft’s contributions exceeded $80 million, supporting initiatives such as AI-powered learning accelerators, Microsoft Teams for Education, and accessibility tools to empower learners across the country.

Sustainable Growth and the Future of Technology

Microsoft’s investment in Poland is not only focused on technological advancement but also on sustainability. The company is committed to becoming carbon negative, water positive, and achieving zero waste by 2030. As part of this effort, Microsoft is working to bring more carbon-free electricity to the grids where it operates through Power Purchase Agreements (PPAs). In Poland, Microsoft has already begun executing PPAs for renewable energy and plans to expand its use of clean energy in the near future.

This commitment to sustainability aligns with Microsoft’s broader global strategy to drive innovation while addressing environmental challenges. By designing and operating energy-efficient data centers and cloud infrastructure, Microsoft is creating opportunities to enhance performance, efficiency, and sustainability, benefiting both Poland and the global community.

Microsoft’s Long-Term Commitment to Poland

This PLN 2.8 billion investment is a testament to Microsoft’s long-standing partnership with Poland, which has spanned over three decades. Since the opening of its first Polish data center in 2023, Microsoft has continued to support the development of the country’s digital ecosystem. The expansion of its cloud and AI infrastructure, coupled with the company’s commitment to cybersecurity, skilling, and sustainability, ensures that Poland remains at the forefront of the digital transformation in Central and Eastern Europe.

As Microsoft continues to invest in Poland’s digital future, it is clear that the company is not just building infrastructure, but also contributing to the creation of a thriving, competitive, and resilient digital economy. With AI, cloud technologies, and cybersecurity at the core of this investment, Microsoft is helping shape Poland’s future as a global leader in innovation and technology.

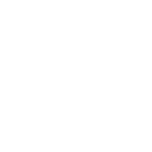

Business Opportunity: EV Battery Production Facilities

The Aerospace Industry in Poland: A Growing Hub in Europe

Poland has become a focal point in Europe’s landscape, boasting a rich history in aviation and a robust, rapidly expanding sector. With strong government backing, a skilled workforce, and a thriving network of businesses, Poland is positioning itself as a key player in both the global industry and space. This article delves into the current state of Poland’s sector, highlighting key regions, major players, and future growth prospects.

Key Developments: A Commitment to Growth

Investment in Space Programs

One of the most promising areas of growth for Poland’s industry is its expanding involvement in space exploration. The Polish government has committed €295 million to the European Space Agency (ESA) for the period 2023–2025. This investment will support key initiatives such as the development of satellite technology, internships for young graduates, and further advancements in space exploration and research.

Poland’s participation in high-profile projects, like the EagleEye satellite mission, underscores its growing capabilities in Earth observation technologies. This commitment places Poland at the forefront of satellite construction and space-based research within Europe.

Technological Advancements Driving Innovation

The Polish industry has a strong focus on innovation and technological development. Companies across the sector are investing heavily in research and development (R&D), driving advancements in manufacturing, materials, and systems.

Poland’s universities are playing a crucial role in this transformation. With approximately 20,000 engineering graduates entering the workforce each year, Poland is cultivating a highly skilled talent pool capable of meeting the needs of the industry. Moreover, modern manufacturing techniques, including 3D printing and automation, are becoming integral to production processes, allowing companies to meet global standards for precision and efficiency.

Regional Aerospace Clusters: Powerhouses of Innovation

Aviation Valley

At the heart of Poland’s aerospace sector lies Aviation Valley, a cluster centered around Rzeszów in southeastern Poland. This region is home to over 200 aerospace companies, including heavyweights like Sikorsky and Lockheed Martin, making it the largest aerospace cluster in Poland. Aviation Valley is responsible for 80-90% of the country’s aerospace output, employing approximately 11,000 people.

The region’s success is rooted in its highly skilled workforce and a long history of collaboration between businesses, educational institutions, and research centers. Aviation Valley remains central to Poland’s aerospace manufacturing, focusing on the production of aircraft components, maintenance, and repairs.

Silesian Cluster

Another notable aerospace hub in Poland is the Silesian Cluster, an area with a rich history of aerospace collaboration that dates back to the 1980s. The Silesian region is focused on fostering technological innovation and strengthening ties between businesses and academic institutions. These efforts have been instrumental in advancing aerospace research, particularly in areas like materials science, robotics, and autonomous systems.

Poland’s Space Sector: Reaching for the Stars

Poland’s space industry has flourished since the country became a member of the European Space Agency (ESA) in 2012. This membership has opened numerous doors for Polish companies to collaborate on key space projects, from satellite launches to Mars exploration. Today, the Polish space sector includes over 400 entities, ranging from small startups to large research institutions, all contributing to the development of cutting-edge space technologies.

Areas of Expertise

Poland has developed specialized expertise in several key areas of the space industry, including:

- Satellite Technology: Polish companies are designing and constructing advanced satellites, with the CAMILA project being a flagship initiative aimed at creating a constellation of Earth observation satellites.

- Earth Observation: Poland’s involvement in EagleEye, a high-resolution Earth observation satellite mission, showcases its growing capabilities in this field.

- Control and Robotics: Polish firms are developing sophisticated control systems and robotics for satellites, enabling automation and precision in space applications.

- Mechatronics & Communication Systems: The sector is also a leader in developing advanced communication systems for satellite operations, supporting everything from telecommunications to scientific research.

International Collaboration and Future Prospects

Poland’s growing role in the aerospace sector is fueled by its international partnerships. As an EU member state, Poland benefits from collaborations with major aerospace manufacturers, including Airbus and Boeing, as well as with space organizations like ESA and NASA. These partnerships facilitate knowledge transfer, foster innovation, and solidify Poland’s position in the global aerospace ecosystem.

Future Growth Outlook

Looking ahead, Poland’s aerospace industry is poised for continued growth. Some key developments include:

- Market Expansion: Poland’s aerospace export market share is expected to increase steadily, from 1.05% in 2024 to 1.17% by 2028. This reflects both growing international demand and Poland’s expanding capabilities.

- Innovation and R&D: Ongoing investments in R&D and education will enhance Poland’s competitive edge, ensuring that the country remains at the forefront of aerospace manufacturing and space technology.

- Strategic Projects: Programs like CAMILA, aimed at creating satellite constellations, will position Poland as a global leader in space-based infrastructure.

- Commercialization: As the sector matures, Poland will see growing opportunities to commercialize its aerospace innovations, strengthening its global competitiveness.

Government Support: Laying the Foundation for Growth

The Polish government has been instrumental in supporting the aerospace sector through both policies and funding. Some key initiatives include:

- National Space Program: Managed by the Polish Space Agency (POLSA), this program aims to increase Poland’s market share in the global space economy while fostering international collaboration.

- Defense Modernization: Poland’s defense contracts, including the acquisition of advanced aircraft like F-35 fighter jets, are providing a significant boost to the aerospace sector.

- EU Funding: Poland leverages EU funds to drive innovation and support SMEs, enabling the country to remain competitive in the global aerospace market.

Conclusion: Poland’s Aerospace Industry on the Rise

Poland’s aerospace industry is on an impressive trajectory, combining a rich historical legacy with cutting-edge technological advancements and strong international partnerships. With major investments in both aviation and space technologies, Poland is poised to become one of Europe’s leading hubs for aerospace innovation and manufacturing. As the industry continues to expand, it will play an increasingly important role in shaping the future of global aerospace, contributing to everything from satellite technologies to defense systems.

Discover how Valians International can support your business in Poland’s growing aerospace sector. Our expertise in international collaboration and industry insights can help you navigate opportunities in this dynamic market.

The Water Treatment Sector in Poland: A Look Ahead to 2025

As Poland moves toward 2025, its water treatment sector is poised for significant transformation. The country is working to modernize its water infrastructure while addressing critical issues such as water scarcity, pollution, and climate change. With ambitious goals to improve water quality and ensure sustainability, Poland’s water sector will be shaped by both challenges and opportunities.

Key Priorities for Poland’s Water Treatment Sector

A major priority in Poland’s water treatment landscape is upgrading municipal wastewater treatment facilities. The government is making strides to reduce nitrogen and phosphorus levels in wastewater, targeting a 75% reduction. This goal aligns with the National Program of Municipal Wastewater Treatment (NPMWT), which has already expanded to cover over 73% of wastewater facilities. However, over 1,000 agglomerations still lack adequate systems, signaling the need for continued investment in infrastructure.

Key Drivers of Change in the Water Treatment Sector

- Environmental Pressures and Water Scarcity Poland’s geographic location and diverse economic sectors, including agriculture and industry, place significant pressure on its water resources. While the country does not face the severe water scarcity seen in some southern European nations, water quality, availability, and pollution remain growing concerns. Climate change, with increasingly erratic weather patterns—such as droughts and floods—will only intensify these issues in the coming years.

- Urbanization and Population Growth Rapid urbanization in Poland means cities like Warsaw, Kraków, and Wrocław will see millions of new residents over the next decade. This urban growth will place additional strain on the country’s water treatment infrastructure. To meet rising demand for clean water, cities will require more efficient, smart water treatment plants, as well as enhanced sewage systems.

- EU Regulations and Sustainability Goals As a member of the European Union, Poland is committed to adhering to EU environmental regulations. By 2025, Poland will continue aligning its water management policies with the EU’s Water Framework Directive (WFD), aimed at ensuring that all European waters achieve good ecological status by 2027. This will necessitate significant upgrades to wastewater treatment plants, stricter monitoring of water quality, and the adoption of advanced technologies for sustainable water usage.

- Technological Innovations The water treatment sector in Poland will benefit from cutting-edge technologies by 2025. Smart water management systems, automation, and real-time monitoring are set to become widespread, improving efficiency and reducing costs. Technologies like artificial intelligence (AI), machine learning, and data analytics will optimize water treatment processes, while innovations in membrane filtration, ultraviolet (UV) disinfection, and electrochemical treatment will improve water quality and treatment efficiency.

- Public Awareness and Engagement Polish citizens are becoming more conscious of the need for responsible water usage. This shift in awareness, driven by environmental NGOs, government campaigns, and international initiatives, is creating a demand for sustainable water solutions. By 2025, this change in public attitudes will further drive the adoption of environmentally friendly water practices and technologies.

Key Developments in Poland’s Water Treatment Sector by 2025

- Modernization of Water and Wastewater Infrastructure Poland’s water and wastewater infrastructure, although reliable, is aging and in need of modernization. Over the next few years, major investments will be directed towards the following upgrades:

- Decentralized Water Treatment Solutions Decentralized systems will play an increasingly significant role in Poland’s water treatment future. While centralized plants remain essential, smaller, local solutions such as greywater recycling, rainwater harvesting, and biological filtration will become more common, especially in rural areas. These systems can relieve pressure on centralized infrastructure, improve resilience, and promote sustainability.

- Advanced Wastewater Treatment and Reuse Poland is expected to emphasize advanced wastewater treatment technologies in urban areas:

- Smart Water Management By 2025, smart water management systems will be integral to Poland’s water treatment efforts. These systems will use sensors, AI, and big data to monitor water quality, detect leaks, forecast demand, and optimize treatment processes. As a result, operational costs will decrease, and environmental impact will be reduced.

- Increased Investment in Water Conservation and Efficiency Poland will continue to invest in water conservation projects to combat water scarcity and meet EU sustainability goals. Key initiatives will include:

- Collaboration with EU and Global Partners Poland will strengthen its partnerships with the EU and international organizations to share best practices and access cutting-edge water management technologies. The EU’s Cohesion Fund will help finance large-scale infrastructure projects, while collaborations with global water management firms will bring advanced solutions to the country.

Challenges Facing the Water Treatment Sector in Poland

Despite the promising outlook, Poland’s water treatment sector faces several challenges:

- Investment Needs: Modernizing infrastructure to meet EU standards will require significant financial resources.

- Climate Change: The country must adapt to climate-related issues such as droughts and floods, which can affect water availability and quality.

- Regulatory Compliance: Adapting to rapidly changing EU regulations and ensuring compliance with water quality standards will continue to be a challenge for municipalities and businesses alike.

Conclusion: A Bright Future for Poland’s Water Treatment Sector

By 2025, Poland’s water treatment sector will be characterized by technological advancements, sustainability efforts, and more efficient processes. The country’s dedication to modernizing its water infrastructure, improving wastewater treatment systems, and aligning with EU regulations will ensure that it remains at the forefront of water management in Europe.

To stay updated on the latest trends, innovations, and news in the water treatment sector, be sure to follow us on LinkedIn. Stay informed as Poland navigates the challenges of water management and sets the stage for a more sustainable future!

Pioneering Sustainability: Łódź Airport and Volta Polska’s Solar Farm Initiative

In an exciting step toward a greener future, Łódź Airport has partnered with Volta Polska to create a state-of-the-art solar farm with a capacity of 12 MWp. This innovative project not only highlights the region’s commitment to sustainability but also positions Łódź as a leader in renewable energy solutions. By harnessing the power of the sun, Łódź Airport is embracing a cleaner, more sustainable future while enhancing energy independence for the region.

Harnessing Solar Power for a Greener Future

Spanning across 13 hectares, the solar farm will feature over 20,000 photovoltaic panels, producing a significant amount of clean energy. With an expected reduction of 8,500 tonnes of carbon emissions annually, this project marks a pivotal moment in Poland’s push towards carbon neutrality. The energy generated will be primarily used to power Łódź Airport and nearby industrial clients, making a considerable contribution to the region’s green energy infrastructure.

This project exemplifies how large-scale renewable energy solutions can help mitigate climate change while providing a reliable, locally-sourced energy supply. By moving towards solar power, Łódź is taking tangible steps to meet global sustainability goals and ensuring that energy production and consumption align with future environmental needs.

Airports as Catalysts for Sustainable Change

Airports, known for their high energy demands, are often seen as significant contributors to carbon emissions. However, Łódź Airport is proving that airports can lead the way in sustainable practices. Through the development of this solar farm, the airport is not only reducing its own carbon footprint but is also making a lasting positive impact on the surrounding community.

The excess energy produced by the solar farm will be distributed to nearby industrial sectors, contributing to a circular economy. This collaborative approach fosters a ripple effect of environmental benefits, where green energy powers multiple facets of the local economy.

A Location with Rich Heritage and Future Potential

The location of the solar farm itself is an intriguing blend of history and innovation. The 13-hectare site has previously served as a backdrop for notable Polish films, making it a landmark of cultural significance. By repurposing this land for solar energy production, the project represents a perfect marriage of past and future. This duality embodies the broader transformation happening in Łódź, as the city focuses on revitalizing its urban spaces, enhancing its infrastructure, and fostering a culture of innovation.

This site’s legacy adds a unique dimension to the solar farm project, which not only supports renewable energy but also encourages a revitalization of the region’s cultural and historical narrative.

Łódź: A City in the Midst of a Green Revolution

Łódź is in the midst of a transformative phase, both in terms of urban development and environmental consciousness. The solar farm at Łódź Airport is an example of how sustainable solutions can be integrated into the revitalization process. By investing in renewable energy, the city is setting a benchmark for sustainable urban development that other cities can follow.

This initiative is part of a broader effort to position Łódź as a hub for green innovation, where the economy, environment, and culture intersect. As a pioneer in renewable energy solutions, the city is leading by example, demonstrating that sustainability is not just a trend but a necessary and achievable future.

Why This Matters: A Call to Action for Sustainable Development

The Łódź Airport solar farm project is a clear signal that renewable energy is not only an environmental necessity but also an economic opportunity. As we continue to face the challenges of climate change, projects like this demonstrate the immense potential for industries, cities, and communities to adopt sustainable practices that reduce carbon emissions, increase energy resilience, and drive economic growth.

This project should serve as a catalyst for further innovation and collaboration across sectors. Whether in energy, transport, or urban development, renewable energy is key to creating a sustainable, resilient future for all.

Let the Łódź Airport and Volta Polska’s solar farm initiative inspire others to explore the possibilities of green energy solutions in their own communities and industries. Together, we can contribute to a cleaner, more sustainable planet while driving progress and growth for future generations.

Ready to Drive Your Own Sustainable Future?

Are you interested in exploring innovative, sustainable energy solutions for your business or organization? Whether you’re looking to implement renewable energy strategies or need guidance on integrating solar power into your infrastructure, Valians International can help. Our team of experts is ready to work with you on custom energy projects tailored to your needs.

Get in touch today to learn how we can help you take the next step toward sustainability and energy independence.

Poland’s Life Sciences Sector in 2025: A Hub of Innovation and Economic Growth

Poland’s life sciences sector is rapidly emerging as one of the most dynamic and innovative fields in Europe. With strategic investments, top-tier talent, and cutting-edge advancements in biotechnology, pharmaceuticals, medical devices, and digital health, Poland is positioning itself as a central hub for life sciences in Central and Eastern Europe (CEE). The sector not only fuels the country’s economic growth but also contributes significantly to addressing global healthcare challenges.

Key Figures of Poland’s Life Sciences Sector in 2023

Poland’s life sciences sector is a key driver of the national economy. With a market revenue of $100 billion, Poland ranks among the largest life sciences markets in the CEE region. This growing industry employs over 320,000 people, highlighting its critical role in providing jobs and boosting the economy.

- More than 50% of production is exported, with major markets including Germany, France, and Italy.

- Poland’s life sciences sector contributes approximately 4% of the country’s GDP, underscoring its economic significance.

Poland’s Life Sciences Landscape in 2025

Biotech Sector Growth

The biotechnology industry in Poland is experiencing significant expansion, especially in biopharmaceuticals. This sector is rapidly advancing through the production of human proteins and peptides using advanced genetic engineering techniques. As patents for existing biopharmaceuticals expire, the focus has shifted towards the production of biosimilars, further driving growth.

Poland’s biotech industry is supported by a robust academic research foundation. The country boasts over 37 universities offering biotechnology programs and more than 250 R&D institutions contributing to the development of innovative solutions.

Government initiatives, such as R&D funding programs, are also fueling biotech advancements and fostering public-private collaborations.

Rare Diseases Plan

In September 2024, the Polish government launched the Rare Diseases Plan for 2024-2025, allocating approximately €22 million to improve healthcare services for patients with rare diseases. This plan focuses on creating new specialist centers throughout Poland by the end of 2025, enhancing access to diagnostics and treatment.

The initiative is part of Poland’s broader effort to enhance healthcare infrastructure, ensuring that rare disease patients receive the necessary care and support.

Emerging Trends Shaping Poland’s Life Sciences Industry

Digital Transformation in Healthcare

The life sciences industry is undergoing a significant digital transformation, with companies increasingly adopting data-driven technologies to improve R&D processes and patient care. Digital platforms are enhancing patient engagement and providing insights that lead to better healthcare outcomes. This shift towards patient-centric models integrates data analytics into decision-making, revolutionizing treatment plans and operational strategies.

R&D Investment Driving Innovation

Poland’s life sciences sector continues to benefit from substantial investments in research and development (R&D). In recent years, Polish biotech companies have increased R&D spending to nearly 1.5 billion PLN annually, which is crucial for developing innovative products and maintaining competitiveness in the global market.

Evolving Regulatory Environment

Poland is ensuring that its regulatory landscape remains conducive to innovation. Programs like Horizon Europe facilitate collaboration between academia and industry, enabling Poland to stay at the forefront of scientific research in Europe. These initiatives also play a key role in advancing regulatory frameworks that balance innovation with patient safety.

Challenges in Poland’s Life Sciences Sector

While the future looks promising, there are several challenges that Poland’s life sciences sector must address:

- Supply chain vulnerabilities: The global healthcare supply chain is under strain, and Poland must work to address these issues to ensure continued success.

- Skills gap: The demand for a highly skilled workforce in biotechnology is growing, but there is a shortage of practical training programs for graduates.

- Strategic development: There is a need for a cohesive, national strategy to guide the development and future growth of biotechnology in Poland.

Poland’s Life Sciences Sector: A Bright Future Ahead

As Poland moves toward 2025, its life sciences sector is poised to become a leading player in Europe. With strong foundations in biotechnology and pharmaceuticals, along with significant government support and ongoing investment in R&D, Poland is well-positioned to capitalize on its growing influence in the global life sciences market. Overcoming current challenges will be key to realizing the country’s full potential as a global hub for life sciences innovation.

Follow our LinkedIn page to stay informed about key developments, industry innovations, and opportunities that will drive the future of healthcare and biotechnology.

Vietnam vs. Poland: Strategic Comparison for The United States Small Business Expansion

Poland and Vietnam, situated in Eastern Europe and Southeast Asia respectively, have emerged as some of the fastest-growing economies in the world over the last three decades. Despite their geographical, cultural, and historical differences, these two nations share remarkable similarities in their paths to economic transformation. Once victims of war and socialist planned economies, both Poland and Vietnam have become success stories of rapid development, providing valuable lessons for countries aiming to break free from poverty.

Historical Parallels: From Adversity to Resilience

During the 20th century, both nations faced devastating challenges. Poland endured partitioning, foreign domination, and the impacts of World War II, followed by decades of a centrally planned economy under Soviet influence. Vietnam, meanwhile, suffered from colonial rule, the Vietnam War, and the constraints of a command economy.

In 1990, Vietnam’s GDP per capita stood at a meager $98, one of the lowest globally, while Poland’s average monthly salary hovered around $50, making it one of the poorest nations in Europe. Both countries, however, adopted bold reforms that would transform their trajectories.

- Poland embraced free-market reforms in the early 1990s, leveraging its accession to the European Union in 2004 for structural funding and trade opportunities.

- Vietnam initiated its Đổi Mới (Renovation) policy in 1986, transitioning from a collectivist model to a market-oriented economy, opening up to foreign investment and trade.

Vietnam’s Economic Outlook

Vietnam has become a cornerstone of Southeast Asia’s economic growth, playing a pivotal role in the region’s transformation into one of the fastest-growing markets globally over the past decade. Key drivers include:

- Strong Economic Growth: Vietnam’s GDP is projected growth of 6-7% for 2023-2024, driven by domestic consumption, exports, and key sectors like electronics, textiles, and technology.

- Foreign Direct Investment (FDI): Vietnam attracted nearly $31.4 billion in the first 11 months of 2024, with over 60% of FDI focused on manufacturing, especially in electronics and consumer goods.

- Inflation and Labor Dynamics: Inflation is projected to rise to 4–4.5% in 2024, with a young workforce (over 50% of the population under 35) and competitive wages, positioning Vietnam as a cost-effective manufacturing hub.

- Renewable Energy and Trade Relations: The government’s focus on renewable energy (solar and wind power) presents new opportunities, while strong trade relations with key partners like the The United States, EU, and China strengthen Vietnam’s global position.

Vietnam faces challenges such as inflation, the need for improved productivity and innovation, and addressing workforce upskilling. Infrastructure and environmental sustainability also require attention.

Poland’s Economic Outlook

Poland has become a cornerstone of Eastern Europe’s economic growth, significantly contributing to the region’s transformation into one of the fastest-growing parts of Europe over the past two decades. Key drivers include:

- EU Support: As a member of the European Union, Poland has received substantial EU funds to modernize infrastructure, energy systems, and education. In 2025, GDP growth is projected at 3.0%, supported by strong private consumption and investment driven by EU funding.

- Cost-Effective Skilled Labor: Poland’s workforce combines technical expertise with cultural compatibility with Western Europe, attracting foreign investors. The average wage growth is expected to reach 12.3% in 2025, indicating a competitive labor market.

- Geopolitical Relevance: The ongoing conflict in Ukraine has increased Poland’s strategic importance, particularly in logistics, defense, and energy sectors. For example, defense spending is projected to reach 2.6% of GDP in 2024 due to heightened security concerns.

Despite its progress, Eastern Europe faces disparities among countries in economic development and infrastructure, necessitating nuanced strategies for regional engagement.

Key Similarities Between Vietnam and Poland

- Strategic Location: Vietnam serves as a gateway to the ASEAN market, while Poland connects to the EU, with over 500 million consumers.

- Strong Manufacturing Sectors: Vietnam is a hub for electronics, textiles, and furniture, while Poland leads in automotive, machinery, and household appliances.

- Growing Tech and Digital Transformation: Vietnam is investing heavily in software development, data centers, and e-commerce, while Poland is advancing in IT services and digital infrastructure.

- Skilled Workforce: Vietnam has a young population with a focus on upskilling, while Poland boasts a highly educated workforce, especially in IT, engineering, and manufacturing.

- Investor-Friendly Policies: Vietnam attracts FDI with tax incentives and industrial zones, while Poland offers access to EU funds and incentives for manufacturing, IT, and infrastructure.

- Growth Potential: Vietnam shows strong GDP growth, driven by exports, domestic consumption, and manufacturing. Poland is set to recover and show steady growth, supported by infrastructure development and its role in Ukraine’s reconstruction.

Key Opportunities and Strategic Approaches

Vietnam: Opportunities & Strategy

Vietnam presents significant opportunities for growth across various sectors. Establishing manufacturing facilities can capitalize on the ongoing global supply chain shifts, while focusing on the expansion of digital services, fintech, and software development aligns with the country’s growing digital economy.

The government’s support for renewable energy, particularly through incentives, offers further avenues for investment in solar and wind power. Additionally, leveraging trade agreements such as RCEP and CPTPP can help businesses expand into broader Asian markets, enhancing Vietnam’s strategic position in global trade.

Poland: Opportunities & Strategy

Poland offers excellent opportunities for businesses aiming to access the European market, acting as a gateway to the broader EU. With its skilled workforce, particularly in IT, engineering, and digital services, Poland is an ideal location for investment in these sectors. The country’s focus on renewable energy and digital infrastructure presents growth opportunities in the green and digital economy.

Additionally, targeting Poland’s expanding middle class with consumer-focused products and services can capitalize on the increasing demand within the country’s dynamic consumer market.

Final Thoughts

In summary, Vietnam offers strong growth and a young, competitive workforce, making it ideal for labor-intensive industries and access to fast-growing Asian markets. Poland, with its stability, skilled labor, and EU access, is a prime location for tech, advanced manufacturing, and green energy investments. Both markets provide unique opportunities for growth and diversification.

The Pharmaceutical Sector in Poland: Trends and Outlook for 2025

The pharmaceutical industry in Poland has been a cornerstone of its healthcare and economic systems, demonstrating consistent growth over the years. In 2024, the sector continued to expand, driven by advancements in research and development (R&D), supportive government policies, and growing demand for innovative treatments. This article explores the current state, key drivers, and future prospects of Poland’s pharmaceutical sector.

Industry Overview

Poland boasts one of the largest pharmaceutical markets in Central and Eastern Europe, with a market size exceeding €11 billion. The sector includes a mix of multinational companies, domestic firms, and contract manufacturing organizations. Key players such as Polpharma, Adamed, and Celon Pharma dominate the local landscape, while international giants like Pfizer, Novartis, and Sanofi also maintain significant operations in the country.

The industry is characterized by its dual focus on generics and innovative medicines. While generics form the backbone of the domestic market, accounting for about 70% of sales by volume, there is an increasing emphasis on biopharmaceuticals, orphan drugs, and personalized medicine.

Key Drivers of Growth

1. Rising Healthcare Expenditure

Poland’s healthcare spending has been steadily increasing, with public and private investments aimed at improving healthcare infrastructure and access. In 2025, government funding for healthcare is projected to rise further, supporting both the reimbursement of medicines and innovation in pharmaceutical research.

2. Robust R&D Ecosystem

Poland has become a hub for clinical trials in Europe, thanks to its skilled workforce, cost-effective environment, and large patient population. Approximately 500 new clinical trials are launched annually, with oncology, neurology, and cardiology being the primary focus areas. Government programs such as the National Centre for Research and Development (NCBR) are instrumental in financing innovative drug development.

3. Growing Exports

The Polish pharmaceutical sector has a strong export orientation. In 2025, exports are expected to grow, particularly to European Union (EU) markets, as well as to emerging economies in Asia and Africa. This growth is underpinned by Poland’s compliance with EU regulatory standards and its reputation for producing high-quality generics.

4. Digital Transformation

Digital health technologies, including telemedicine, AI-driven drug discovery, and blockchain for supply chain transparency, are reshaping the industry. Companies are increasingly adopting these tools to enhance efficiency and patient engagement.

Challenges Facing the Sector

Despite its growth, the pharmaceutical industry in Poland faces several challenges:

- Regulatory Complexity: Lengthy approval processes and frequent changes in pricing and reimbursement policies can hinder market access.

- Workforce Shortages: A shortage of qualified professionals in specialized fields like biopharmaceutical R&D remains a bottleneck.

- Pressure on Margins: Price controls on reimbursed drugs and competition in the generics market continue to put pressure on profit margins.

Government Initiatives and Policy Framework

The Polish government has introduced various initiatives to support the pharmaceutical sector. The Polish Medical Research Agency (ABM) plays a crucial role in funding clinical trials and fostering collaboration between academia and industry. The Pharmaceutical Strategy for Poland, aligned with the EU’s Pharmaceutical Strategy, focuses on improving access to medicines, boosting local production, and promoting sustainability in drug manufacturing.

Additionally, tax incentives for R&D and funding under the EU Recovery and Resilience Facility (RRF) are driving innovation and technological adoption in the industry.

Future Outlook

Looking ahead, the Polish pharmaceutical sector is poised for sustained growth in 2025 and beyond. Key trends shaping the future include:

- Expansion in Biopharmaceuticals: With rising demand for biologics and biosimilars, companies are investing heavily in biomanufacturing capabilities.

- Increased Focus on Sustainability: Environmental concerns are prompting companies to adopt green manufacturing practices and reduce their carbon footprint.

- Advances in Precision Medicine: The integration of genetic data into healthcare is paving the way for personalized treatments, particularly in oncology and rare diseases.

Conclusion

The pharmaceutical sector in Poland is a dynamic and rapidly evolving industry, marked by innovation, resilience, and a growing global presence. While challenges persist, the combination of supportive policies, technological advancements, and an expanding healthcare market positions Poland as a key player in the global pharmaceutical landscape. As the year progresses, the sector is expected to continue driving economic growth and improving health outcomes for patients both in Poland and globally.

Stay tuned for more updates and insights—follow us to keep up with the latest trends and developments in the pharmaceutical industry!

Advanced Manufacturing in Poland: Growth, Innovation, and Future Prospects

Poland’s advanced manufacturing sector has grown significantly, benefiting from its strategic location, skilled workforce, and government support. Poland has become a key player in Europe’s manufacturing and technology fields, with trends focusing on digitalization, automation, and innovation. This progress positions the country for continued success in the global market.

Now, Poland’s manufacturing sector has shifted toward advanced technologies like robotics, AI, IoT, and additive manufacturing since 2020. This modernization enables Poland to compete globally, attract foreign investment, and create high-value jobs.

Key Drivers of Advanced Manufacturing Growth

Poland is advancing digital transformation in manufacturing by adopting Industry 4.0 technologies like IoT, data analytics, and AI. This shift aims to improve efficiency, reduce waste, and enable flexible production, boosting both competitiveness and sustainability.

The Polish government and the EU, through funds like the ERDF, are driving the modernization of Poland’s manufacturing sector. This funding supports R&D, technology adoption, and aids SMEs in their digital transformation, with initiatives such as the “Future Industry Platform” guiding their progress.

Collaborative efforts between industry and academia further ensure the workforce is well-prepared for advanced manufacturing needs.

Trends

Robotics and Automation are one of the most important trends. It is estimated that Polish factories will host tens of thousands of robots, performing tasks that range from assembly and welding to quality control.

Another technological advancement regards 3D printing that has become a key tool in Poland, particularly in industries like aerospace and medical devices, where rapid prototyping and customized parts are essential. It helps companies reduce lead times, minimize waste, and enhance product customization. The ability to quickly create prototypes fosters innovation, allowing for faster design iterations.

Polish manufacturers are increasingly leveraging AI and machine learning for data-driven decision-making, improving predictive maintenance, quality control, and supply chain optimization. This use of AI-driven analytics has helped optimize production, reduce downtime, and enhance product quality.

Another key focus in Poland concerns as well Sustainability. Manufacturers are adopting circular economy models, energy-efficient technologies, and waste reduction strategies. These efforts not only meet EU sustainability goals but also boost the global competitiveness of Polish products.

Industry-Specific Developments

Several industries within the Polish manufacturing sector have made significant strides in advanced manufacturing practices.

One of it is the automotive industry that is leading the way in adopting advanced manufacturing technologies, focusing on electric vehicles (EVs) and autonomous driving. Major automakers like Volkswagen and Toyota have heavily invested in Polish facilities, integrating high automation and robotics. The sector is also embracing sustainable manufacturing practices, particularly in producing eco-friendly vehicle components.

Also, Poland’s aerospace sector has grown by focusing on advanced materials, 3D printing, and precision engineering. Collaborations with global giants like Airbus have boosted local suppliers, leading to the adoption of advanced production techniques and quality standards. This growth has also advanced R&D in lightweight materials and composite technologies.

The electronics sector also has grown considerably, driven by increased demand for consumer electronics, telecommunications equipment, and components for smart devices. Polish electronics manufacturers are integrating IoT and AI into their production processes to produce more complex and high-quality electronics for both domestic and international markets.

The Road Ahead: Prospects for 2025 and Beyond

Poland’s advanced manufacturing sector is poised for continued growth, with an emphasis on innovation, sustainability, and digital transformation. Both private and public sector investments in R&D will drive further technological breakthroughs and enhance the global competitiveness of Polish manufacturers.

With Industry 4.0 technologies becoming more affordable, Polish manufacturers are likely to expand their adoption of smart factory models, where interconnected systems communicate in real time to optimize productivity and quality.

As global attention to climate change intensifies, sustainable manufacturing practices will be a central pillar of Poland’s industrial strategy. Circular economy models and green energy solutions will play an increasingly important role.

Poland is strategically positioned to become a vital part of Europe’s reconfigured supply chain network, serving as a nearshoring hub for companies looking to reduce dependency on distant suppliers.

Conclusion

With strong government support, an adaptable workforce, and robust international partnerships, Poland has emerged as a leader in adopting advanced manufacturing technologies in Central and Eastern Europe. As the country continues to embrace innovation and sustainability, Poland’s advanced manufacturing sector is expected to thrive, solidifying its place in Europe’s industrial future.

To stay ahead in the ever-evolving world of advanced manufacturing, follow Valians International on LinkedIn. By connecting with us, you’ll gain valuable insights, industry updates, and innovative solutions that can help drive your business forward.

The Central Transport Hub (CPK): Transforming Poland’s Transportation Landscape

Poland is on the brink of an extraordinary transformation in its transportation infrastructure. The Central Transport Hub (CPK) project, a massive investment initiative, is set to modernize the nation’s transport system by integrating air, rail, and road networks into a seamless, high-capacity system. This landmark project, which includes a new central airport and a state-of-the-art high-speed rail network, is poised to significantly enhance Poland’s connectivity both domestically and internationally.

In this article, we’ll explore the key components of the CPK project, its projected impact on the economy, job creation, and the timeline for its completion.

What is the Central Transport Hub (CPK)?

The Central Transport Hub (CPK) is one of the most ambitious infrastructure projects in Poland’s history. Positioned strategically between Warsaw and Łódź, the CPK aims to serve as a major transportation nexus, combining an airport and a railway station to enhance Poland’s connectivity within Europe and beyond.

Key features of the CPK include:

- Central Airport: A new airport located 37 km west of Warsaw, designed to handle 34 million passengers annually initially. This modular airport will be capable of future expansions to accommodate growing demand, with a long-term goal to serve 40 million passengers and 1 million tons of cargo annually.

- High-Speed Rail Network: The project includes a National High-Speed Rail Network (KDP), which will provide rapid, direct rail connections between major cities such as Warsaw, Łódź, Poznań, and Wrocław. The priority KDP “Y” line, set to achieve speeds of up to 320 km/h, will connect these cities and ensure swift and efficient travel.

- Intermodal Connectivity: The CPK will integrate the airport with both the rail network and road infrastructure, creating a multi-modal hub that enables seamless travel and transport across various systems. This approach ensures Poland’s position as a critical transport hub in Central and Eastern Europe.

Why is the CPK Important for Poland?

The CPK is not just about building new infrastructure; it’s about creating a modern, sustainable transport ecosystem that drives economic growth and job creation. By 2032, the estimated cost of the project will reach 131.7 billion PLN (approximately 30 billion euros), making it a major economic driver for the region.

Economic Impact:

- Boosting Connectivity: With the development of both a major airport and an advanced rail network, Poland will become a key transportation hub for international travelers, businesses, and freight. This will enhance the country’s global competitiveness and attract international investments.

- Job Creation: The project is expected to generate 238,000 jobs by 2028, with a long-term total of 290,000 CPK-related jobs by 2040. These jobs will span aviation, rail, construction, logistics, and service sectors, contributing significantly to Poland’s economy and reducing regional unemployment.

CPK’s Modular Design and Expansion Plans

The CPK is designed for long-term service with the flexibility to grow as demand increases. The modular airport structure will enable phased construction, starting with an initial capacity of 34 million passengers annually, and can expand in phases to accommodate up to 40 million passengers. This expansion will depend on market demand and passenger traffic growth.

The high-speed rail system will also be developed in phases, with the first segment of the KDP “Y” line connecting Warsaw, Łódź, and other major cities set for completion by 2032. Full completion of the KDP network is projected by 2035, linking even more cities across Poland and Central Europe.

Project Progress: Current Status and Future Actions

The CPK project is already well underway, with significant progress made in key areas:

- Design Work: The design for the passenger terminal is 50% complete, led by the renowned architectural firm Foster+Partners. Additionally, the design for the technical infrastructure, including runways and taxiways, is about 40% complete and is being handled by Dar Al-Handasah Consultants.

- Land Acquisition: To date, 38% of the land required for the airport has been acquired, with 70-80% of the remaining landowners expressing interest in selling their properties. A voluntary land acquisition program for properties along the future high-speed rail line will be launched later this year.

- Construction Permit: The CPK expects to receive the construction permit for the airport in the first quarter of 2026, marking a crucial milestone for the start of construction.

Timeline for Completion

- 2032: The first phase of the project, including the airport terminal and the initial section of the high-speed rail network, will be completed. The airport will be ready to accommodate 34 million passengers annually.

- 2035: The full high-speed rail network (KDP) is expected to be completed, ensuring seamless connectivity between Poland’s major cities and enhancing the overall transport efficiency.

CPK: A Vision for the Future

The Central Transport Hub (CPK) is more than just an infrastructure project; it is a vision for Poland’s future. By creating a world-class transport hub that integrates air, rail, and road systems, CPK will enhance Poland’s standing as a regional leader in transportation and logistics. The project promises to bring not only economic benefits but also long-term growth, innovation, and job creation to the region.

For businesses, travelers, and the local economy, the CPK represents an exciting new chapter in Poland’s development, with the potential to reshape how people and goods move within Poland and beyond.

About Valians International

At Valians International, we specialize in delivering innovative solutions for businesses engaged in large-scale infrastructure projects. As Poland progresses with the transformative CPK project, we are here to guide your business through the opportunities and challenges it presents. Whether you’re looking to expand operations, navigate new partnerships, or enhance your strategic planning, we offer the expertise you need to succeed in this dynamic environment. Reach out to us today to learn how we can help you capitalize on the growing potential of Poland’s transportation sector.

EU Approves 40 Billion PLN in Recovery Funds for Poland: A Major Boost for Green Energy, Infrastructure, and Healthcare

On November 12, 2024, the European Commission approved Poland’s second and third payment requests from the National Recovery Plan (KPO), amounting to a significant 40 billion PLN. This major financial approval, announced by Poland’s Minister of Funds and Regional Policy, Katarzyna Pełczyńska-Nałęcz, marks a key step in the country’s efforts to recover from the economic impact of the COVID-19 pandemic and transition to a more sustainable, resilient economy. With two more payment requests planned for submission by the end of the year, this is just the beginning of Poland’s transformative recovery journey.

What Are EU Recovery Funds and How Do They Help Poland?

The EU’s recovery funds, allocated through the Recovery and Resilience Facility (RRF), are designed to help member states recover from the pandemic’s economic fallout. Poland’s National Recovery Plan (KPO) outlines how the country will invest these funds to address critical areas like green energy, digital infrastructure, healthcare, and social services.

With a total of approximately 58 billion EUR allocated to Poland, the funds are aimed at supporting long-term, sustainable economic growth and resilience. Poland’s KPO is aligned with the European Union’s broader climate and economic goals, focusing on decarbonization, digital transformation, and improving public services.

Key Investments from the 40 Billion PLN Approval

The 40 billion PLN approval is a critical milestone for Poland, enabling the country to advance several high-impact projects in key sectors. These investments will support Poland’s transition to a low-carbon economy, enhance public services, and create jobs, all while boosting the country’s overall economic resilience.

- Green Energy and Offshore Wind Farms – 10 Billion PLN A significant portion of the funds, approximately 10 billion PLN, will be directed towards offshore wind farms in the Baltic Sea. This investment is part of Poland’s strategy to reduce its reliance on coal and embrace renewable energy sources, aligning with the EU’s green transition goals. By expanding offshore wind capacity, Poland aims to not only enhance its energy security but also contribute to the global fight against climate change.

- Railway Renovations and New Trains – 7.4 Billion PLN With 7.4 billion PLN earmarked for railway infrastructure, Poland is set to modernize its rail network, improving connectivity and reducing carbon emissions from transport. This investment will fund the renovation of old railway lines, the construction of new routes, and the procurement of modern, energy-efficient trains, offering a sustainable transportation solution for Poland’s citizens.

- Healthcare Investments – 4.7 Billion PLN A portion of the funds, 4.7 billion PLN, will be allocated to improving Poland’s healthcare system. Specifically, the funds will support the construction of new oncology hospitals and elderly care facilities. This is a direct response to the growing healthcare demands of an aging population, helping to strengthen Poland’s health infrastructure and ensure that all citizens have access to high-quality medical care.

- Home Insulation and Furnace Replacement – 3 Billion PLN Poland will also invest 3 billion PLN in home insulation and the replacement of old, inefficient heating systems. This initiative will help to reduce energy consumption, lower heating costs for Polish households, and reduce the country’s carbon emissions. This aligns with Poland’s broader climate goals and its commitment to reducing its environmental footprint.

- Public Transport: Buses – 2.1 Billion PLN In a bid to modernize public transport, 2.1 billion PLN will be dedicated to the purchase of eco-friendly buses. This initiative aims to reduce air pollution, support sustainable urban mobility, and improve the quality of life for Polish citizens by enhancing access to efficient and low-emission public transport.

- High-Speed Internet Infrastructure – 1.5 Billion PLN The recovery funds will also provide 1.5 billion PLN for the expansion of high-speed internet infrastructure. This investment is vital for bridging the digital divide, improving connectivity in rural areas, and supporting Poland’s digital transformation. Access to high-speed internet is crucial for remote work, online education, and fostering innovation across industries.

Why This Approval Is Crucial for Poland’s Economic Future

The approval of 40 billion PLN is not just about financial support; it’s about securing Poland’s long-term economic resilience and sustainable development. These investments are strategically aligned with Poland’s goals of:

- Achieving a Low-Carbon Economy: By investing in renewable energy, sustainable transport, and energy-efficient homes, Poland is taking concrete steps towards reducing its carbon emissions and meeting its climate targets.

- Modernizing Infrastructure: From railways to buses to high-speed internet, the KPO funding will significantly improve Poland’s infrastructure, making it more competitive in the global market and enhancing the quality of life for its citizens.

- Strengthening Healthcare: The focus on healthcare, particularly in oncology and elderly care, will help Poland address the challenges posed by an aging population and ensure that its healthcare system is equipped to meet growing demand.

- Creating Jobs: With investments spanning diverse sectors, from green energy to public transport, these funds are expected to create thousands of jobs, contributing to Poland’s recovery and providing opportunities for workers in emerging industries.

Looking Ahead: The Fourth and Fifth Payment Requests

Minister Pełczyńska-Nałęcz has indicated that Poland plans to submit its fourth and fifth payment requests by the end of 2024, which will continue to support similar projects in the areas of green energy, infrastructure, healthcare, and digital transformation. These additional funds will further cement Poland’s path toward a sustainable, modern economy and help the country maintain its recovery momentum as it moves into the post-pandemic era.

Conclusion

The approval of 40 billion PLN in recovery funds by the European Commission is a transformative development for Poland, unlocking vital investments that will shape the country’s future. By focusing on green energy, infrastructure modernization, healthcare, and digital connectivity, these funds are helping Poland recover from the pandemic and build a more resilient and sustainable economy.

At Valians International, we understand the importance of strategic investments in economic recovery and transformation. As Poland continues its journey towards a sustainable future, we are committed to helping businesses and organizations navigate these changes and seize opportunities in the evolving landscape. Learn more about how we can support your organization in adapting to new challenges and driving long-term success in the global market.

Hydrogen Factory to be Built in Silesia: A Game Changer for Poland’s Green Energy Future!

The Agencja Rozwoju Przemysłu (ARP) is set to embark on a transformative venture with the construction of a hydrogen production facility in Silesia, Poland. This ambitious project, in collaboration with three partners, including a technology partner, is projected to cost between €1.5 billion and €2 billion, as highlighted by ARP President Michał Dąbrowski.

Project Overview

Dąbrowski emphasized that this initiative is aimed at revolutionizing Poland’s economy, particularly within the transportation and ecological sectors. The facility will focus on producing green hydrogen through the electrolysis of water powered by renewable energy sources. This green hydrogen will not only serve as an energy carrier in fuel cells for road and rail transport but also hold potential for energy generation, heating, and various industrial applications, including the production of green ammonia.

Investment Details

In the first phase of this investment, ARP plans to allocate PLN 600 million (approximately €140 million) next year. Additionally, the agency is exploring funding opportunities from the European Hydrogen Bank to further support this significant project. Dąbrowski noted that the goal is to establish a comprehensive value chain for hydrogen production and utilization, integrating technology development, production capabilities, and innovative applications across various sectors.

Strategic Importance

Dąbrowski referred to the hydrogen plant as a “game changer” for the region, positioning Silesia at the forefront of the green hydrogen market. This project aligns seamlessly with Poland’s broader strategy to transition from coal dependency towards sustainable energy solutions. The partnership with a technology provider underscores ARP’s commitment to leveraging advanced technologies in hydrogen production.

Future Prospects

ARP’s vision extends beyond mere production; it encompasses a holistic approach to developing hydrogen applications across industries such as refining and chemicals. This initiative is a crucial part of Poland’s efforts to decarbonize its economy and enhance its competitiveness in the emerging global hydrogen market.

Conclusion

In summary, ARP’s planned hydrogen facility represents a pivotal step in Poland’s energy transformation. It promises substantial economic and environmental benefits while positioning Silesia as a leader in green technology. This project not only reflects a commitment to sustainable energy but also highlights the potential for innovation and growth in the region’s economy.

Stay tuned for more updates on this exciting journey towards a sustainable future!

Poland’s IT Sector: A Landscape of Opportunities

In 2024, Poland’s IT sector is experiencing remarkable growth, solidifying its reputation as a key hub for technology in Europe. The sector is projected to contribute approximately 8-9% to Poland’s GDP, with market values estimated between PLN 70 billion and PLN 85 billion. The software and IT services segment is particularly dominant, accounting for about two-thirds of the total market and trending towards a 70% share, reflecting a shift typical of advanced economies.

Current Market Dynamics

The demand for IT services has surged as businesses continue to adapt to digital transformation. This trend has been accelerated by the COVID-19 pandemic, which forced many traditional businesses to embrace digital channels. In 2024, the Polish IT sector is characterized by a diverse range of companies, including around 50,000 software firms, from small startups to large multinational corporations. Notably, major global players like Microsoft and Google have made significant investments in the Polish market. Microsoft launched its first cloud data center in Central and Eastern Europe in 2023, while Google announced a €590 million investment in a new office complex in Warsaw that will employ 2,500 people. These developments underscore Poland’s attractiveness as a destination for tech investment.

Labor Market Trends

Despite global economic challenges, Poland’s IT job market remains robust. The country boasts a talent pool of approximately 500,000 skilled IT professionals, making it an appealing location for tech talent. The entry of new enterprises and the expansion of Global Business Services have further increased job opportunities in the sector. Currently, IT professionals are increasingly prioritizing flexible working conditions and company culture when considering job changes. A survey revealed that many employees are not actively seeking new positions but remain open to lucrative offers. Salary continues to be a significant factor influencing job mobility.

Cybersecurity and Cloud Services

The rise in cyber threats has heightened the focus on cybersecurity within the Polish IT landscape. Companies are increasingly investing in cybersecurity solutions to protect against malware and phishing attacks. As digital transformation progresses, the need for robust cybersecurity measures will only grow. Cloud services are also thriving in Poland, driven by their cost-effectiveness and accessibility. The ongoing transition to cloud-based solutions is expected to continue shaping the market dynamics throughout 2024.

Government Initiatives

The Polish government is actively promoting digitalization through various initiatives aimed at enhancing the country’s technological infrastructure. Programs providing free laptops to schoolchildren and funding for local digitization projects reflect this commitment.

Opportunities Ahead

Looking forward, several key areas present significant opportunities for growth in Poland’s IT sector:

- Cybersecurity: Increased demand for security solutions as cyber threats escalate.

- Cloud Computing: Continued adoption of cloud technologies across various industries.

- Internet of Things (IoT): Expansion of IoT applications in sectors like manufacturing and logistics.

- 5G Development: Ongoing efforts to enhance telecommunications infrastructure.

Poland’s IT sector is poised for continued success in 2025, attracting both local and international investments while addressing the challenges posed by global economic conditions. The combination of a skilled workforce, supportive government policies, and growing demand for technology positions Poland as a vibrant tech hub in Central and Eastern Europe.

If you would like to learn more about the Polish IT landscape or explore potential partnerships, feel free to contact us. We’re here to help you navigate this exciting market!

Poland: Labor Market Trends & Forecast 2025

Poland has emerged as one of Europe’s key economic players, with its strong labor market and business-friendly environment making it an increasingly attractive destination for investment. In this article, we will explore the key trends shaping the Polish labor market in 2024, forecast what the market will look like in 2025, and provide valuable insights on salary expectations across industries, particularly for sales professionals.

Poland Today: A Growing Economy

Poland is home to a population of approximately 37.5 million, with its capital, Warsaw, housing over 1.86 million residents. In recent years, the country has witnessed robust economic growth, driven by its strategic location, skilled workforce, and stable economic policies. Poland’s GDP was 790 billion Euros in 2024, projected to grow to 829 billion Euros by 2025, with a steady growth rate of 3.5%.

The Polish economy is also characterized by a stable currency (Zloty), with 1 Euro currently worth 4.22 PLN. In terms of employment, the country enjoys a low unemployment rate of 5% in both 2024 and 2025, which signals a healthy labor market. The average gross monthly salary for Polish workers in 2025 is forecast to reach 8,673 PLN (approximately 2,030 Euros), marking a 7 to 8% increase from the previous year. The minimum wage is also set to increase to 4,666 PLN (about 1,106 Euros) in 2025.

Labor Market Highlights of 2024

In 2024, the Polish labor market was shaped by a variety of trends:

- Stable Unemployment: The unemployment rate remained steady at 5.1%, reflecting a strong demand for workers in diverse sectors.

- Hybrid Work Models: The trend towards flexible work arrangements became more widespread, with 65% of companies adopting hybrid work models. This shift was driven by employees’ desire for a better work-life balance, with 45% of workers preferring this system.

- Employee Retention: Employee turnover rates were reduced in 2024, with the average length of employment per position rising to 4.2 years, signaling improved job satisfaction and employee retention.

- Impact of Immigration Policies: Tightening immigration policies affected sectors that traditionally relied on foreign labor, such as transportation and construction. The number of registered foreign workers in Poland decreased by approximately 5% compared to 2023.

Poland’s Labor Market Outlook for 2025

Looking ahead to 2025, Poland’s labor market is expected to remain dynamic, but companies will face challenges in sourcing qualified candidates:

- Recruitment Activity: A staggering 86% of employers plan to hire in 2025, but 53% of them anticipate difficulties in finding the right talent. The demand for skilled workers, particularly in automation, robotics, and electrotechnics, will remain high.

- Salary Increases: Companies are expected to implement salary increases in 2025, with most hikes ranging from 7 to 8%. For sectors facing a shortage of skilled professionals, such as automation and robotics, salary increases of 10 to 15% are expected to attract top talent.

- Salary Transparency: By June 2026, Poland will implement salary transparency policies, requiring companies to disclose salary information to promote fairness and equity in compensation.

- Global Events and Political Factors: The ongoing conflict in Ukraine could potentially affect Poland’s labor market. The potential departure of Ukrainian refugees, who have significantly contributed to the workforce, may exacerbate labor shortages in certain sectors. Additionally, the political landscape in Poland, with presidential elections scheduled for May 2025, could affect the stability of immigration policies.

Salary Insights for 2025

Industry Trends: While salary expectations in Poland depend on industry, professional experience, and location, certain sectors are expected to see higher salary growth in 2025. The demand for professionals in automation, robotics, and electrotechnics is expected to outpace other industries, leading to more substantial salary increases.

Salaries by Sector: The average salary across Poland is expected to reach 8,673 PLN in 2025. However, certain sectors, such as IT, finance, and pharmaceuticals, will offer higher salaries, while industries like hospitality and retail are likely to offer lower compensation.

Key Findings for Employees: 60% of employees are actively seeking new job opportunities due to insufficient salaries, while 48% are motivated by a lack of career development prospects. Therefore, employees are not only looking for competitive pay but also for opportunities to grow within their roles.

Employer Perspective: Nearly 49% of employers are recruiting to accommodate business growth, while 35% are replacing departing employees. However, 53% of employers are concerned about the challenge of finding qualified candidates, highlighting the increasing competition for top talent in specialized fields.

The Impact of AI and Automation

Artificial intelligence (AI) is gradually transforming the Polish labor market. By 2025, 46% of employees are expected to work in environments where AI is already in use, with 53% of companies promoting AI adoption. While AI offers many benefits, including increased efficiency and productivity, it also raises concerns about job displacement.

In response to these concerns, many companies are investing in workforce upskilling programs to ensure their employees are equipped with the necessary skills for the future. AI-related fields such as data analysis, machine learning, and AI programming are expected to grow rapidly, driving demand for skilled professionals who can develop and manage AI systems.

Sales Positions and Salary Trends for 2025

Sales professionals are expected to see salary increases in 2025, with sectors such as pharmaceuticals, IT, and finance offering some of the highest salaries. For example, Sales Directors in these industries may earn up to 35,000 PLN per month, while other positions, such as Sales Managers and Representatives, can expect to see salaries ranging from 8,000 to 20,000 PLN, depending on experience and sector.

Salary increases are also anticipated for eCommerce and real estate sales professionals. Companies in high-demand industries will be offering competitive compensation packages to attract the best talent.

Conclusion: Adapting to Poland’s Evolving Labor Market

Poland’s labor market in 2025 is set to be dynamic, with strong economic growth and a high demand for skilled professionals. Companies must stay agile, adjusting their recruitment strategies to find and retain top talent in an increasingly competitive environment.

Salary increases will be common, particularly for specialized sectors like automation, robotics, and electrotechnics. Companies that embrace salary transparency and invest in workforce development, particularly in AI and automation, will be better positioned to thrive in this evolving market.

As businesses navigate these changes, they must remain mindful of external factors such as global events and political shifts. The ability to adapt and anticipate labor market trends will be key to maintaining success in Poland’s ever-evolving economy.

Contact us today to discuss how we can help you adapt your recruitment and workforce strategies for success in 2025 and beyond.

Overview of The Sourcing in Metalworking Market

The metal industry in Poland is a key pillar of the national economy, encompassing diversified sectors such as machining, welding and forging. With a long tradition of metal construction production, Poland continues to modernise thanks to significant transfers from the European Union and an attractive tax system. With a highly qualified, productive and abundant workforce in a country of 37 million inhabitants, the Polish market attracts a great deal of foreign direct investment. 🇵🇱💡

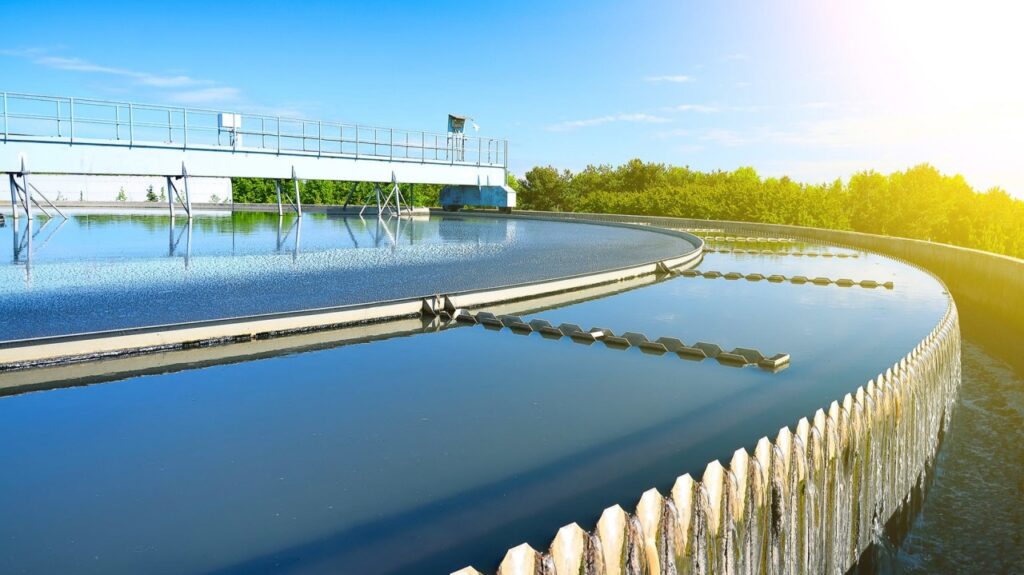

Minimum wage increase in Poland

On 1 July 2024, the gross monthly minimum wage in Poland was increased to PLN 4,300 (around EUR 1,000). This increase of +1.4% compared to 1 January 2024 and +19.4% year-on-year (y-o-y) marks a significant change for many workers.

🔍 Key figures :

- 23.9% of employees, or 3.6 million people, are affected by this revaluation, according to the Ministry of Labour.

- In the 1st quarter of 2024, the average monthly wage in the corporate sector rose by 14.4% year-on-year, reaching PLN 8147.38 (EUR 1895).

For 2025, the government is proposing a one-off minimum wage increase of 7.6% to PLN 4,626, in response to continued wage pressure.

This measure reflects Poland’s ongoing commitment to improving the living and working conditions of its citizens.

Renewable energy in Poland

Poland is at the forefront of the green revolution, breaking records in #renewableenergy production while reducing its dependence on coal to an all-time low. Renewables and nuclear power are forecast to dominate 74% of our energy market by 2040, and the opportunities for global suppliers in this sector are unprecedented. From major onshore wind installations to groundbreaking offshore projects, Poland is positioning itself as a European powerhouse when it comes to sustainable energy.

Join us in shaping a cleaner, greener future for #Poland and the world. 🇵🇱💡

🌟 𝗘𝘅𝗰𝗶𝘁𝗶𝗻𝗴 𝗡𝗲𝘄𝘀! 𝗣𝗵𝗿𝗼𝗻𝗲𝘀𝘆𝘀 𝗲𝗻𝘁𝗲𝗿𝘀 𝘁𝗵𝗲 𝗣𝗼𝗹𝗶𝘀𝗵 𝗺𝗮𝗿𝗸𝗲𝘁 𝘄𝗶𝘁𝗵 𝗩𝗔𝗟𝗜𝗔𝗡𝗦 𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹! 🌟

We are excited to collaborate with Phronesys as they enter the Polish market! Our combined expertise and commitment to excellence will drive significant growth and innovation in this dynamic region.

The Phronesys’ mission extends beyond geographical expansion. The company is committed to guiding companies on their QHSE/ISO digitalisation journey and offer an all-in-one digital tool for managing Quality, Health, Safety, and Environment. They also specialize in digital transformation for QHSE/ISO management systems. From software implementation to consultancy, Phronesys drives organizations into a new era of efficiency.

Here’s to a successful and prosperous journey together! 🌟🚀

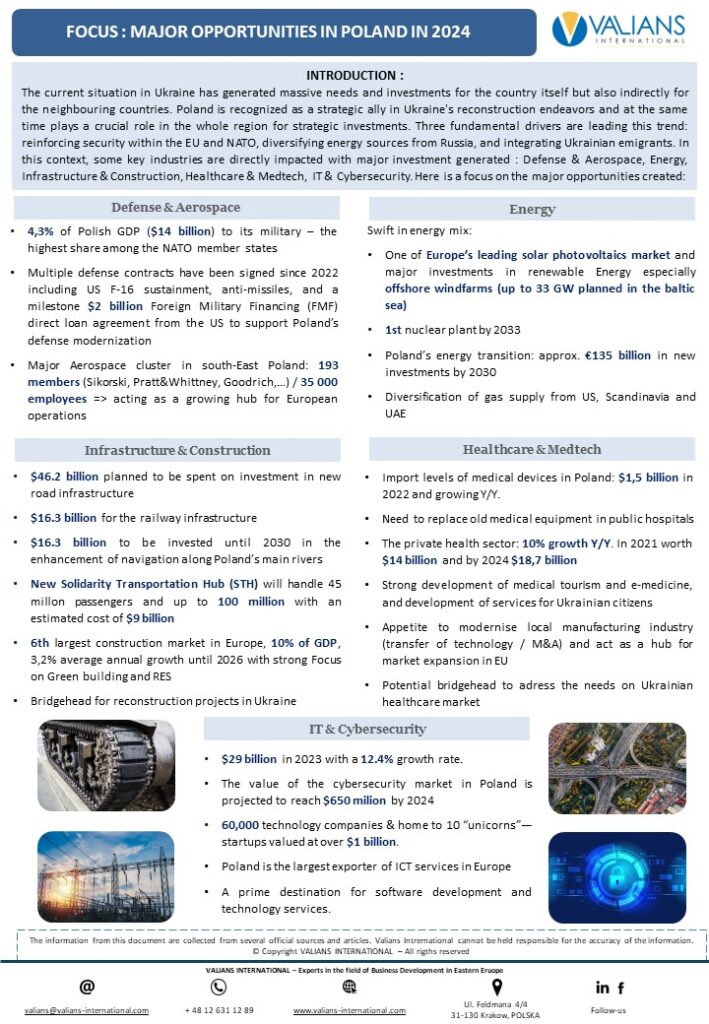

FOCUS: Major opportunities in Poland in 2024